As a result, they tend not to market self-directed IRAs, which supply the flexibility to take a position within a broader variety of assets.

Criminals sometimes prey on SDIRA holders; encouraging them to open up accounts for the goal of generating fraudulent investments. They usually fool traders by telling them that In the event the investment is approved by a self-directed IRA custodian, it needs to be authentic, which isn’t real. Yet again, make sure to do extensive due diligence on all investments you choose.

The primary SDIRA principles through the IRS that investors want to comprehend are investment restrictions, disqualified persons, and prohibited transactions. Account holders need to abide by SDIRA regulations and regulations as a way to protect the tax-advantaged standing of their account.

And since some SDIRAs like self-directed regular IRAs are subject matter to required bare minimum distributions (RMDs), you’ll have to plan in advance to make certain that you've got sufficient liquidity to satisfy The principles set with the IRS.

A self-directed IRA is definitely an unbelievably powerful investment automobile, but it really’s not for everyone. Because the declaring goes: with good electrical power comes great duty; and using an SDIRA, that couldn’t be much more correct. Continue reading to find out why an SDIRA may, or might not, be for you.

This includes comprehending IRS regulations, managing investments, and keeping away from prohibited transactions that may disqualify your IRA. An absence of information could cause high-priced errors.

Bigger Expenses: SDIRAs generally come with better administrative expenditures when compared with other IRAs, as particular elements of the executive method can not be automated.

Earning by far the most of tax-advantaged accounts enables you to hold extra of the money you commit and generate. Determined by no matter if you choose a standard self-directed IRA or even a self-directed Roth IRA, you might have the probable for tax-absolutely free or tax-deferred expansion, delivered sure ailments are met.

Complexity and Accountability: With the SDIRA, you see this site may have much more Handle more than your investments, but You furthermore may bear extra obligation.

A lot of buyers are stunned to learn that using retirement money to take a position in alternative assets has been feasible due to the fact 1974. Nonetheless, most brokerage firms and financial institutions deal with presenting publicly traded securities, like stocks and bonds, mainly because they lack the infrastructure and know-how to control privately held assets, like housing or personal fairness.

Put only, if you’re seeking a tax productive way to construct a portfolio that’s extra tailor-made to the interests and knowledge, an SDIRA may be the answer.

Including dollars on to your account. Remember that contributions are matter to annual IRA contribution boundaries set by the IRS.

If you’re looking for a ‘set and forget’ investing technique, an SDIRA probably isn’t the right choice. Because you are in full Command around each individual investment built, It is really your choice to perform your own personal due diligence. Keep in mind, SDIRA custodians are not fiduciaries and can't make tips about investments.

Due Diligence: It is really identified as "self-directed" for the cause. With an SDIRA, you are solely answerable for extensively researching and vetting investments.

No, You can not put money into your personal business that has a self-directed IRA. The IRS prohibits any transactions among your IRA and your individual enterprise because you, as being the operator, are regarded a disqualified person.

Entrust can support you in paying for alternative investments with the retirement money, and administer the getting and offering of assets that are generally unavailable by banks and brokerage firms.

Unlike stocks and bonds, alternative assets will often be harder to offer or can come with rigid contracts and schedules.

Have the liberty to invest in Pretty much any kind of asset using a hazard profile that matches try here your investment approach; including assets which have the probable for a better rate of return.

No matter whether you’re a monetary advisor, investment issuer, or other monetary Skilled, examine how SDIRAs can become a strong asset to mature your organization and obtain your professional ambitions.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Ralph Macchio Then & Now!

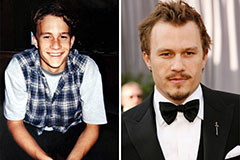

Ralph Macchio Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!